Deciding to sell a personal vehicle is always a big decision, prompted by various circumstances. This may be prompted by a change of location, a financial decision, or simply a desire to switch brand or model. Regardless of the motivation, the process of selling a car in the UAE has certain factors that must be taken into account.

The used car market in the UAE is characterised by high competition and specific regulations, so choosing the method of sale is one of the factors for a successful transaction. You can turn to an official dealer, try to sell the car yourself through advertisements or specialised online platforms, or use the services of intermediaries. This article will help you navigate and avoid common mistakes.

Recommendations Before Selling Your Car

Before listing your car for sale in the UAE, it is advisable to prepare it. Here’s what you need to do.

Fines

Before selling the car, make sure to pay off all existing fines. This applies to any traffic violations: improper parking, speeding, etc. Failure to comply with this condition may lead to legal problems for the new owner and additional difficulties and expenses for you to resolve the situation.

Before finalising the sale, check for outstanding fines through relevant online services or by contacting the official authority in the UAE. It’s better to spend a little time checking and paying than to face unpleasant consequences in the future.

Remember that the responsibility for unpaid fines lies with the vehicle owner until the re-registration is complete, so take care of this in advance to ensure a smooth transaction without delays. Make sure that all financial obligations are fully met and only after that can you confidently sign the sale documents.

Car Loans

Selling a car purchased on credit is a bit more complicated. Before handing over the vehicle to the new owner, you must fully close the loan agreement. It’s best to do this a few days before the intended transaction to give the bank time to process all necessary documents.

Without fully paying off the loan, you will not be able to transfer the car to the new owner, as the relevant authorities in the UAE (specifically, the RTA) will not allow the transfer of ownership.

In exceptional cases, the bank may agree to transfer the car loan to the new buyer, but such practices are rare and require additional approvals. Therefore, the most reliable way is to pay off the loan yourself before selling.

Car Insurance

Selling a car in the UAE involves changing the status of the insurance policy. You must either terminate it or transfer it to the new owner. The second option is possible if the term of your current policy exceeds seven months, and you also need to obtain the insurance company’s consent for this procedure.

If the policy is valid for more than seven months, you have the right to terminate the contract and receive a refund for the unused portion of the insurance premium. Therefore, contact your insurance company to find out the details and clarify the procedure for reissuing or canceling the policy.

Pre-Sale Inspection and Car Wash

Before listing your car for sale, you need to prepare it. This will increase its attractiveness to potential buyers and, as a result, allow you to sell the car at a higher price.

The first step is a thorough diagnosis of the vehicle. It is advisable to contact the RTA for a complete technical inspection. This will help identify and eliminate all existing faults, as well as provide a report confirming the car's good condition. Having such documents increases buyer trust and helps avoid haggling over hidden defects. When you sell your car on Carabia, the pre-sale inspection is included for free and a mobile inspection can be carried out at the location and time of your choosing by our partners Verify Buy.

Next, it is recommended to wash and polish the body, as well as to clean the interior. A clean and well-maintained car makes a much better impression than a vehicle that looks neglected.

Pay attention to the following details:

-

Remove dirt from the body;

-

Polish the paintwork to eliminate minor scratches;

-

Clean the interior to remove stains and odors;

-

Clean the trunk;

-

Clean the windows and mirrors;

-

Tidy up the engine compartment (if desired).

How to Sell a Used Car in Dubai Yourself

There are many ways to sell your car in Dubai, but direct contact with buyers without intermediaries remains one of the most common. Although selling a car directly may seem like a challenging task, there are ways to simplify this process.

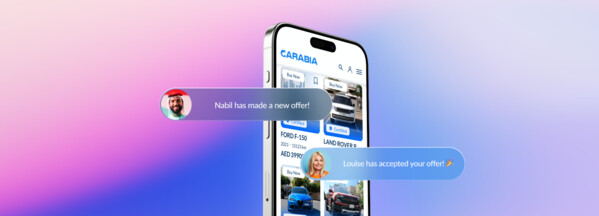

The online platform Carabia specialises in supporting private car sellers. Our platform provides access to a large number of buyers, helping you sell your car quickly, at a good price, and with minimal costs. We take on much of the hassle associated with self-selling, providing a simple process for posting ads and attracting interested buyers.

Online selling of used cars through the Carabia service is beneficial because the seller receives the maximum price, avoiding commissions and dealer fees.

Advantages of Selling a Car Yourself in Dubai:

-

All proceeds from the sale remain with the seller;

-

You set the desired price;

-

There are no additional intermediaries in the deal;

-

The process of posting an ad is simple.

Disadvantages:

-

You will have to independently control the sales process;

-

You may have to schedule meetings with potential buyers at inconvenient times.

Determine the Price of Your Car

The price of your vehicle is, in fact, the first thing potential buyers pay attention to. If it is set correctly, it increases the chances of a quick and profitable deal. Let’s figure out how to determine the adequate value of your car.

First, you need to assess the state of the automotive market in the UAE. Pay attention to offers for similar cars – brand, model, year of manufacture, mileage, and configuration. Review ads on popular online platforms, visit car dealerships, and automotive markets. Compare the characteristics of your car with competitors' offers.

Factors influencing the price include:

-

Mileage;

-

Availability of service history;

-

Condition of the body and interior;

-

Availability of additional options;

-

Overall wear and tear.

If the car has any faults or damage, this must be taken into account.

Pay attention to the operation of the engine, transmission, suspension, and electronics. Identify any defects that may lower the price. It’s better to conduct a diagnosis yourself or consult a mechanic for an independent assessment.

When determining the price of the car, also consider the specifics of the UAE market. There is high demand for certain brands and models of cars in the country. This can influence the price of the vehicle either positively or negatively. Remember that the set price should be competitive but also reflect the actual condition of the car.

Take Quality Photos of the Used Car from Different Angles

To attract the attention of potential buyers, prepare a series of photographs. You need at least seven shots that show the car from all sides. The recommended set of photos includes:

-

Front view (from the left and right sides);

-

Rear view (from the left and right sides);

-

Interior (photos of the front and rear parts of the cabin);

-

A ‘hero’ shot taken diagonally to the front wheel.

If the car has special features or modifications, be sure to capture them in the photos. This will highlight its uniqueness and interest buyers.

Prepare a Description of the Technical Specifications of the Car

After uploading the photos, move on to describing the technical specifications. Specify all parameters of the vehicle as accurately and thoroughly as possible. The more information you provide, the clearer the picture will be for the buyer. Skipping this step risks wasting a lot of time answering questions about the configuration, features of the car, and other nuances.

Do not hide existing defects. If the car has damage – dents, scratches – be sure to describe them. Honesty will help avoid misunderstandings during the inspection. If the car has a verified service history, be sure to mention this.

Additionally, buyers often inquire about other aspects, including:

-

Number of previous owners;

-

Existence of bad habits in the driver (e.g., smoking in the cabin);

-

Use in off-road conditions;

-

Remaining warranty period.

The more complete and accurate the information in the sales ad, the higher the likelihood of finding a suitable buyer without unnecessary hassle.

Do Not Stick Advertisements on the Body or Inside the Car

Placing advertisements for the sale of a car directly on the vehicle itself may result in a fine. The laws of the UAE regulate the placement of advertising materials in public places, and such actions can be viewed as a violation of the rules. Therefore, if necessary, it is better to use other channels.

Although digital technologies have become the dominant method of selling cars in the UAE, some traditional methods are still in effect. For example, you can publish a sales ad in a local newspaper; some publications have specialised sections for the automotive market.

In addition to print media, bulletin boards can also be used. However, before placing information, it is necessary to ensure that this is permitted in the specific location.

How to Sell a Car in Dubai Using Trade-In

An alternative way to get rid of an old car is to trade it in at an official dealer. Many car dealerships in Dubai and other emirates offer this service. This is an attractive option for those who want to quickly acquire a new vehicle using the proceeds from the sale. The selling process takes minimal time since the interaction occurs with a single counterparty.

Advantages of Trading in a Used Car at a Dealer:

-

The procedure takes only a few hours, as you will only interact with a representative of the dealership.

-

The possibility of getting a new car immediately if the dealer offers a similar model. Thus, you do not remain without transportation.

-

Professional assistance in handling documents, which is especially convenient if you are not well-versed in legal nuances.

Despite the obvious benefits, trading in a car also has drawbacks:

-

Not all dealerships support immediate payment. In some cases, the car is accepted for consignment sale, and you receive money only after the car is sold.

-

The possibility of trade-in is limited to the car brand. Some dealers do not accept vehicles of certain brands or deliberately undervalue the buyback price.

-

For cars purchased on credit, there are restrictions. A necessary condition for trade-in in most cases is the full repayment of obligations to the bank, although some dealerships make exceptions.

How to Sell a Car to a Dealership in Dubai

Specialised dealerships that offer instant car purchases operate successfully in Dubai. This is a convenient alternative to traditional sales through ads or car dealers. Among the most well-known platforms are Sell Any Car, Simply Car Buyers, and We Buy Cars DXB. Each of them offers its conditions, but the general idea remains the same: a quick transaction and receiving money for the car without unnecessary hassle.

The purchase procedure usually takes just a few minutes and consists of three stages: online assessment, confirmation of value, and transaction completion. The preliminary assessment helps to educate you on the possible price, but the final amount is determined after a personal inspection of the car by the company's specialists.

Advantages of Quick Purchase:

-

Immediate payment in cash, bank transfer, or check. You receive money right away, without waiting for a buyer or completing lengthy procedures.

-

Minimal time expenditure. You only need to visit the company’s office once to complete the transaction.

-

Full assistance in preparing all necessary documentation. The service takes care of bureaucratic issues, simplifying the process.

-

The possibility of selling cars with outstanding loans. Some companies offer to buy financed vehicles and pay off the debt to the bank themselves.

Disadvantages of Quick Purchase:

-

The offered price is likely to be lower than with a self-sale. Companies are interested in quick resale, so they offer a price that accounts for their expenses and profits.

-

Not all cars are accepted for purchase. Services typically do not buy vehicles that are not operational or have significant damage. This limitation is due to the business being built on the resale of cars.

Requirements for the Seller Before Sale

Before heading to the RTA center to register the transfer of ownership, check for all necessary documents and compliance with the re-registration conditions.

Here’s what is required from the seller:

-

Original vehicle registration card. This document is usually referred to as "Mulkiya." Without it, the re-registration procedure is impossible. Ensure that the card is in excellent condition; if there are any damages, it is better to address them in advance. If your Mulkiya is stored digitally, make sure you have it easily accessible.

-

Originals and copies of ID/passport. It is advisable to bring both versions of the documents. The original will be needed for identity verification, while copies will be useful for filling out forms.

-

Personal presence or the issuance of a power of attorney. Usually, the seller must be present when submitting the re-registration application. However, if this is not possible due to objective reasons, a notarised power of attorney can be issued to another person authorised to act on your behalf. The power of attorney should clearly specify the representative's powers, including the right to sign and provide necessary information. Clarify all the nuances of issuing a power of attorney with the RTA in advance to avoid additional delays.

Documents Required from the Buyer

To register the car sale transaction in the UAE, the buyer must prepare several mandatory documents. This is a standard procedure that simplifies the process and guarantees the legality of the transaction.

-

A valid insurance policy for the car. If the buyer does not have one, the policy can be arranged on-site at the time of the transaction.

-

Passport with a valid visa confirming the right to reside in the UAE (original document).

-

Emirates ID (original).

-

UAE driver’s license (valid).

If the buyer resides in another Emirate, in addition to the above documents, they will need to provide proof of their residence. Acceptable forms include:

-

A rental agreement with a current utility payment receipt (water, electricity) in the buyer's name, and a copy must be notarized;

-

Documents proving ownership of property in the UAE (notarised copy).

Mandatory Fees When Selling a Car in Dubai

The main fee for registration when selling a vehicle in Dubai is AED 20. This amount is fixed and is charged for processing the information regarding the change of ownership.

In addition to the basic fee, an additional commission of AED 100 is charged for transferring data during the re-registration of documents. This is due to the necessity of updating information in the relevant vehicle database.

Please note that the specified amounts are standard and may vary slightly depending on current legislation and the specifics of the transaction. Before selling a car, it is advisable to clarify the current fee amounts with the relevant government bodies or specialists dealing with such operations.

Transferring Insurance

If your auto insurance policy is valid for seven months or more, the seller typically transfers it to the new owner. However, this depends on the specific insurance company, so be sure to clarify this nuance with your insurer before selling.

Another option is to terminate the contract and receive a refund for the unused amount. Insurance companies usually agree to this if the policy term does not exceed seven months. To confirm the cancellation of the insurance contract, you will need to provide a copy of the new vehicle registration certificate in the buyer's name.

Features of Selling a Car with an Outstanding Bank Loan

Reselling a car taken on credit involves several steps:

-

Agreement with the Lender. Start by contacting the bank or financial institution that provided the loan. Discuss with the manager the possibility of selling the vehicle and find out about the necessary documents and procedures. You need to obtain official permission to sell and clarify what actions will be required from you and the buyer.

-

Finding a Buyer. Find a buyer willing to purchase the vehicle under the specified conditions. Inform them about the vehicle, including its service history and condition.

-

Joint Visit to the Lender. After agreeing on the deal with the buyer, arrange a meeting at the bank. All three parties – you, the buyer, and the lender’s representative – must be present. This is important for discussing the terms of the deal.

-

Debt Payment. The buyer fully pays off the remaining loan amount.

-

Document Preparation. After the debt is paid, all necessary documents for the loan repayment and the sale of the car are signed.

-

Registration of Ownership Transfer. Contact the relevant government authorities in the UAE to officially register the transfer of ownership to the buyer. You will need documents confirming the loan repayment and the sale.

The exact order of actions and necessary documents may vary depending on the terms of the loan agreement.

Conducting Financial Settlements Between Seller and Buyer

After completing all formalities and signing the documents, the stage of financial settlements begins. Ideally, the transfer of money should occur in the presence of both parties and, preferably, with the involvement of an independent witness. This will help avoid disputes and disagreements in the future.

The most common and safest method of payment is cash. However, it is advisable to observe certain precautions:

-

Before handing over the money, carefully count the entire amount in the presence of the buyer. Ensure that the bills match the denomination and are undamaged.

-

It is preferable to count the money in a well-lit place where each bill can be examined in detail.

-

Document the fact of the transfer of funds. This can be done by recording the vehicle number and the buyer's personal details in the sales contract. You can also take photos of the entire amount of money before handing it over.

-

It is not recommended to accept payment through dubious schemes lacking confirmations. Avoid using checks, especially expired ones or those issued in the name of third parties, as they may be counterfeit.

Where is the Best Place to Sell a Car in Dubai?

Car owners often consider two options for selling their vehicle in Dubai: self-searching for a buyer or turning to a car dealer. The first method is generally more profitable, as you set the price yourself and do not share the profit with intermediaries. However, you need to take care of preparing the advertisement, allocate time for communicating with potential buyers, organising inspections, and handling documentation. To expedite this process and increase the chances of a quick sale, post an ad on the online platform Carabia. This service provides access to a wide audience of potential clients, with a total audience of millions of users. The Carabia online platform offers transparent terms for posting ads, without hidden fees and coverage limitations.

In contrast to private sales, dealerships offer a faster way to part with your vehicle. They are ready to purchase the car almost instantly, taking on the entire process of completing the transaction. This eliminates bureaucratic complexities and saves your time. However, it is worth remembering that the buyback price at a dealership is likely to be lower than in a direct sale to an individual.

FAQ

What documents are needed to transfer ownership of a car in Dubai?

To transfer ownership of a car in Dubai, you will need the UAE citizen ID (for both seller and buyer), the vehicle registration certificate (Mulkiya), a valid insurance policy in the name of the future owner, a technical inspection report (for vehicles older than three years), and a signed sales contract.

How much does it cost to transfer ownership of a car in Dubai?

The price depends on the type of vehicle. For passenger cars, it is 350 dirhams. For heavy vehicles and buses, the amount will be higher. Additionally, there is a fee of 50 dirhams for processing the contract and 20 dirhams for information services.

Where can I transfer ownership of a car in Dubai?

You can transfer ownership at any RTA customer service center or authorized companies.

Is a pre-sale technical inspection necessary?

If the car is more than three years old, a technical inspection at an accredited RTA center is mandatory before sale.

Can I transfer ownership of a car if there are unpaid fines?

No. All fines for traffic violations must be paid off before completing the transfer process. The system will not allow you to proceed until all debts are fully settled.

How can I prepare a car for sale?

Before selling, clean the car and fix any minor issues. Gather all necessary documents so that you can move quickly if you have an interested buyer.

Where can I find buyers for my car in Dubai?

The Carabia online platform offers a convenient and free service for posting ads for private car sales. It’s a simple and transparent way to find a buyer without unnecessary costs.

Can I sell a car if it is under loan?

Yes, but you will need to either pay off the remaining loan balance in advance or arrange with the buyer and the bank to settle the remaining debt as part of the deal.

Who pays for the transfer?

Typically, the buyer pays the transfer fee, which is around 350 dirhams.

Is it necessary to provide a vehicle inspection report?

Yes, for vehicles older than three years, a technical inspection certificate will be required.

Can I transfer insurance to the new owner?

If there are at least seven months remaining on the policy and the buyer meets the insurer’s conditions, this is possible. In other cases, the policy will be canceled, and you will receive a refund for the unused period.

How can I assess the value of my car before selling?

You can use various online tools that calculate an estimated price based on data about the make, model, year of manufacture, mileage, and condition of the car.

Can I sell a car through a third party?

Yes, you can issue a power of attorney to another person to sell the car on your behalf. However, this must be officially notarised through a court.